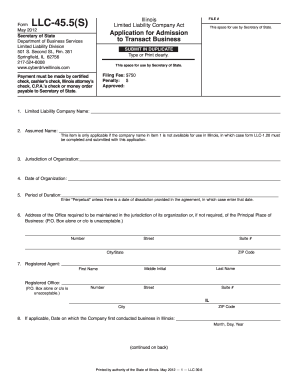

IL LLC-45.5(S) 2018-2026 free printable template

Show details

This document is an application form for Limited Liability Companies (LLCs) seeking admission to transact business in the state of Illinois. It collects necessary information about the LLC including

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign llc 45 5 form

Edit your illinois form llc 45 5 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il llc 45 5 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit llc 45 5 instructions online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit illinois application transact business form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL LLC-45.5(S) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out application for admission to transact business form

How to fill out IL LLC-45.5(S)

01

Obtain a copy of the IL LLC-45.5(S) form from the Illinois Secretary of State's website or local office.

02

Fill in the name of the limited liability company at the top of the form.

03

Provide the LLC's registration number, if applicable.

04

Complete the sections requesting information about the business address, including street, city, state, and zip code.

05

Indicate whether the LLC is a domestic or foreign entity.

06

Fill out the details about the designated agent, including their name and address.

07

Provide the names and addresses of the LLC members or managers, ensuring accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form either online or through the mail, along with any required fees.

Who needs IL LLC-45.5(S)?

01

Any individual or business entity that wants to form a limited liability company (LLC) in Illinois.

02

Existing LLCs in Illinois looking to report changes or update their information may also need to complete and file this form.

03

Foreign LLCs wishing to register and do business in Illinois must also complete this form.

Fill

illinois llc 45 5

: Try Risk Free

People Also Ask about application for admission

How do I dissolve an LLC in Illinois?

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

How do I dissolve an entity in Illinois?

How do you dissolve an Illinois Corporation? To dissolve your corporation in Illinois, you submit in duplicate the completed BCA 12.20, Articles of Dissolution form by mail or in person to the Secretary of State along with the filing fee.

How much does it cost to form an LLC in Illinois?

Form NumberForm NameFeeLLC 45.20Application for Registration of Name$50LLC 45.20Renewal of a Registered Name$50LLC 45.20Cancellation of a Registered Name$5LLC 45.25Amended Application for Admission$5046 more rows

How long does it take for an LLC to be approved in Illinois?

Mail filings: In total, mail filing approvals for Illinois LLCs take 3-4 weeks. This accounts for the 7-14 business day processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Illinois LLCs take 5-10 business days.

What is a LLC 5?

The LLC-5 is a California State form used when a domestic limited liability company formed in another state (or country) wishes to become a foreign limited liability company in California.

How do I close my LLC business in Illinois?

When you decide to close your business, you must contact the Illinois Department of Revenue regarding your tax liabilities. Contact can be made: electronically through MyTax Illinois, by calling us at 217-785-3707, or.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my llc 45 5 illinois directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your illinois llc application online as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I complete application for llc in illinois online?

Completing and signing state of illinois llc forms online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How can I fill out illinois form llc 5 5 on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your printable llc application form. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is IL LLC-45.5(S)?

IL LLC-45.5(S) is a form used by limited liability companies (LLCs) in Illinois to report their income and expenses, as well as make certain tax filings.

Who is required to file IL LLC-45.5(S)?

LLCs in Illinois that are classified as partnerships for tax purposes are required to file IL LLC-45.5(S) if they have income to report.

How to fill out IL LLC-45.5(S)?

To fill out IL LLC-45.5(S), you need to provide your LLC's name, address, federal employer identification number (FEIN), and report your income and expenses as outlined in the form instructions.

What is the purpose of IL LLC-45.5(S)?

The purpose of IL LLC-45.5(S) is to ensure compliance with state tax regulations by reporting the financial activities of LLCs and determining their tax obligations.

What information must be reported on IL LLC-45.5(S)?

The information that must be reported on IL LLC-45.5(S) includes the LLC's financial statements, income, deductions, credits, and any other relevant tax information as specified in the form instructions.

Fill out your IL LLC-455S online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Llc Application Form is not the form you're looking for?Search for another form here.

Keywords relevant to application for authority to transact business in illinois

Related to form llc 5 5

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.